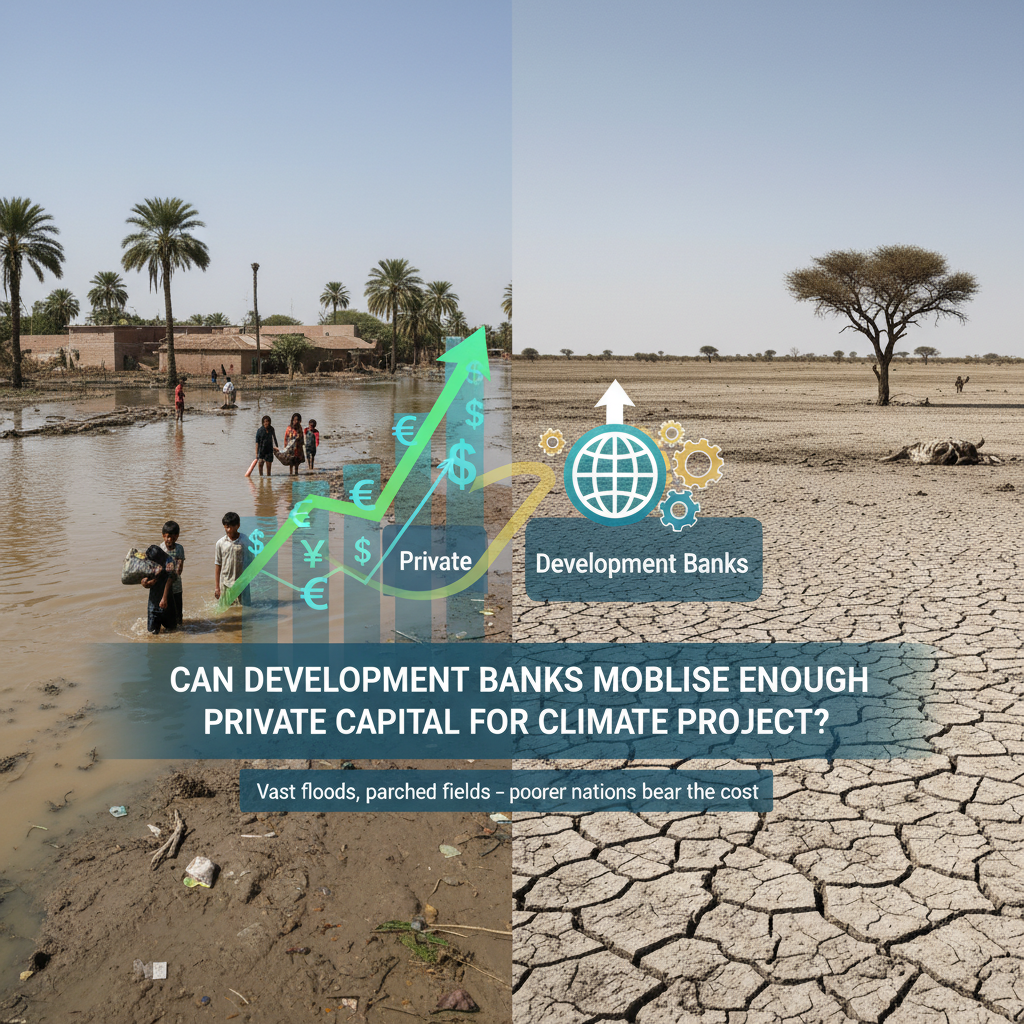

Listen to this post: Can Development Banks Mobilise Enough Private Capital for Climate Projects?

Picture vast floods swallowing villages in Pakistan, or parched fields cracking under endless droughts in Africa. These scenes play out yearly now, and poorer nations bear the brunt. They need billions for sea walls, drought-proof crops, and clean energy grids. Yet the cash falls short. The world faces a climate funding gap of trillions each year. Development banks step in here. These institutions, like the World Bank and Asian Development Bank, lend public money to spark bigger private investments. They offer guarantees and know-how to draw in pension funds and banks wary of risk.

But can they mobilise enough? In 2024, multilateral development banks (MDBs) poured $137 billion of their own funds into climate work, a record high up 10% from before. They pulled in another $134 billion from private sources, a 33% jump. Much of this hit low- and middle-income countries, where needs run deepest. Still, trillions more must flow by 2030. This post looks at fresh wins, stubborn barriers, and a balanced view ahead. We’ll draw on 2025 data and COP30 talks to see if banks can close the gap.

MDBs Rack Up Wins in Attracting Private Funds for Green Work

MDBs show real momentum. They hit $137 billion in direct climate finance last year, with $85 billion flowing to low- and middle-income economies, up 14%. Private cash they mobilised reached $134 billion globally. That’s progress. Adaptation finance, for building defences against floods and heat, doubled to $26 billion since 2019. Banks now eye bolder moves. At COP30 in Brazil last November, they pledged better risk-sharing tools. Mission 300 aims to link every country to clean power by 2030. These steps pull private players into the fold.

Success builds on smart partnerships. Banks blend their loans with private equity to fund solar farms in India or resilient roads in Kenya. Investors like it because banks handle the upfront risks. Take the African Development Bank’s work in solar hubs. Private firms piled in once guarantees kicked off. Numbers back this up. From 2023 to 2024, private co-finance in poorer spots grew 16%. For MDBs’ record $137 billion climate finance announcement, see the full breakdown from the Asian Development Bank.

Spotlight on Banks Like the World Bank and ADB

The World Bank channels funds through local banks to boost resilience. In Bangladesh, it backed flood barriers that now shield millions. The Asian Development Bank teamed with Lightsmith on CRAFT, a facility that speeds clean tech deals in Asia. Results? Faster solar rollouts and grid upgrades.

Africa’s bank launched GAIA loans for green bonds. Private buyers snapped them up for mangrove restoration. The Inter-American Development Bank issued a $1 billion Amazonia Bond. It drew global funds to protect forests. Debt swaps in the Caribbean freed cash for reefs. These cases prove banks can spark action. Outcomes include 10 million more people with clean power.

Numbers That Prove Private Money Is Flowing

MDBs track this via the GEMs database. In 2024, low- and middle-income climate aid topped $85 billion from banks themselves. Private add-ons hit strong marks too. By 2030, banks target $120 billion in own funds yearly for these areas, plus $65 billion mobilised. Adaptation gets $42 billion direct.

High-income countries see $50 billion direct and matching private sums. A simple table shows key players’ shares for low/middle incomes:

| MDB Group | Climate Finance (USD millions, 2024) |

|---|---|

| African Development Bank | 5,517 |

| Inter-American Development Bank | 5,589 |

| European Investment Bank | 4,450 |

These figures show flow. Private money chases bank-backed projects.

Barriers That Keep Private Investors on the Sidelines

Private cash sits idle despite the needs. Cities alone require $4.3 trillion a year by 2030 for climate-proof infrastructure. They get a fraction. Why? Weak project pipelines top the list. Many ideas lack solid plans or local buy-in. Investors spot gaps and walk away.

Data woes compound this. Poor tracking of risks leaves pension funds guessing. Returns look slim next to safe bonds. Emerging markets add currency swings and political shifts. It’s like a builder eyeing a flood-prone site; the rewards don’t match the hassle. Blended finance helps, but scale lags. Urban subsidies for green buildings barely budge.

Fixes demand guarantees and clear rules. Without them, trillions stay parked.

Too Much Risk for Too Little Reward

Investors fear losses in fragile spots. A solar plant in Zambia faces theft or grid failures. Returns hover at 5%, below UK gilts. De-risking tools like first-loss guarantees change that. Banks offer them, then share deals via originate-to-share models.

Eco Invest auctions test this. Private bidders cover 70% of costs once banks pave the way. Still, caution rules. Pension giants demand 10-year horizons with iron-clad backups. UNEP FI’s call to scale private mobilisation urges heads of state to push policies.

Not Enough Solid Projects Ready to Go

Bankable schemes stay scarce. Governments must tie climate goals to budgets. Urban needs scream loudest: sea walls in Jakarta, heat pumps in Lagos. Subsidies gap hits 80%. Banks prep pipelines, but policies lag. One fix? Standard templates for deals. This cuts prep time from years to months.

Can Banks Bridge the Climate Funding Chasm?

MDBs push hard, but can they scale solo? Experts say progress counts, yet gaps yawn wide. The 2026 Washington meeting set priorities: triple private flows via digital tools. COP30 stressed nature finance, like payments for forests. Blends of public and private look key.

Banks hit 2025 targets early. Now 2030 looms. Innovation matters: guarantees, data hubs, local currency bonds. KPMG notes regs must align. Finance groups push synergies across MDBs. Odds improve with bold steps. What holds you back from green bets?

Expert Views and Bold Steps Ahead

KPMG highlights de-risking needs. Groups like EBRD call for joint funds. EIB’s report on the $137 billion milestone backs this. Synergies mean shared pipelines. 2026 brings better tracking.

Wrapping Up: A Path Forward for Climate Cash

MDBs notched wins with $137 billion direct and $134 billion private in 2024. Barriers like risks and weak projects persist. Yet 2030 targets and COP30 pledges offer hope. Banks bridge gaps best through blends.

Support blended finance calls. Watch COP moves and bank reports. Imagine communities safe from floods, farms thriving in heat. Funded projects make it real. Share your take below or sign up for CurratedBrief newsletters on finance shifts.