Listen to this post: Asia’s Rise: India, China and Southeast Asia Set the Global Agenda

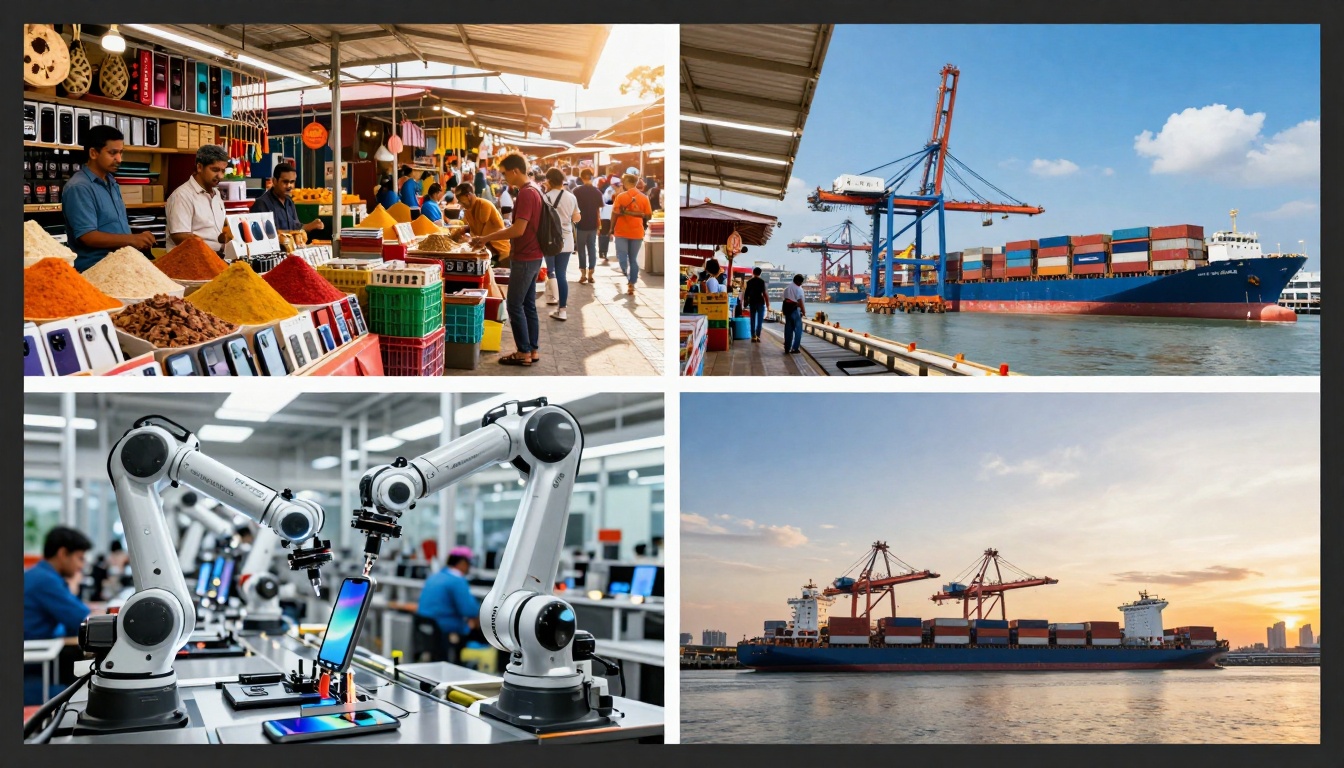

Picture bustling markets in Mumbai where traders haggle over spices and tech gadgets under the midday sun. Factories in Shenzhen hum with robotic arms assembling the world’s smartphones. Ports in Singapore buzz as container ships load goods bound for every corner of the planet. Asia now leads global growth. In 2025, China hit 5% GDP growth. India surged at 6.2% to 7.5%. Southeast Asia averaged 4.3% to 5%, with Vietnam leading the pack.

These numbers tell a big story. Asia drives world trade, tech, and supply chains. China exports grab 15% of the global share despite tariffs. India shifts services and manufacturing from old rivals. Southeast Asia builds new factories for chips and electronics. Leaders in BRICS and ASEAN craft trade deals that shape rules for everyone.

This piece looks at each player’s strengths. We cover China’s factory might, India’s digital boom, Southeast Asia’s supply chain wins, and how they forge global ties. Opportunities abound for businesses and investors. Asia does not just follow; it leads.

China Powers Ahead on Exports and Factories

Massive factories stretch across Shenzhen’s skyline. Cranes lift steel beams while lorries queue to ship electronics worldwide. Ports along the Yangtze River handle billions in cargo daily. China powers global supply chains with unmatched scale.

In 2025, the economy grew 5%, matching targets. Exports rose 8%, claiming 15% of world trade. Even US tariffs hit less than 10% of its shipments. Leaders eye 4.5% to 4.8% growth in 2026, backed by policy tweaks and strong sales abroad. Factories churn out semiconductors and electric vehicles (EVs). Trade-in schemes swap old cars for new ones, boosting demand at home.

Diversification helps. China sells more to Europe, Africa, and Asia. The Belt and Road Initiative links ports and rails from Pakistan to Kenya. Goods flow faster, tying partners closer. This setup keeps costs low and shelves stocked globally.

Manufacturing stays king. Factories upgraded with automation cut waste. Workers train on smart machines. Supply chains shorten as firms build local plants. World brands rely on this edge.

| Country/Region | 2025 GDP Growth | 2026 Forecast |

|---|---|---|

| China | 5.0% | 4.5-4.8% |

| Global Average | 3.2% | 3.0% |

Data from recent forecasts shows China’s lead. China slowdown and India resilience to shape Asia growth highlights how exports cushion slowdowns.

Tech and AI Fuels China’s Export Boom

Semiconductor plants glow with clean rooms. Engineers test chips that power phones and servers. China ramps output to meet AI demand. Exports surged in 2025 as firms grab market share.

Supply chains centre here. Rare earths and assembly lines feed global tech. Rivals face pressure from lower prices and quick scale-up. AI hardware shipments jumped, aiding data centres worldwide.

Firms invest billions. New fabs produce advanced nodes. This shift strengthens China’s hand in tech races.

EVs and Consumer Shifts Keep Growth Steady

EV factories roll out sleek batteries. Trade-in programs lure buyers with cash for clunkers. Sales climbed 30% in 2025. Factories in Guangdong export to Europe and beyond.

Consumers swap petrol cars fast. Roads fill with quiet rides. By 2030, leaders aim for half the market electric. This fuels jobs and cuts oil imports. Daily life changes as charging stations dot cities.

India Charges Forward with Services and Digital Growth

Call centres in Bangalore light up at night. Young coders tap keyboards, fixing bugs for US banks. Streets buzz with delivery bikes carrying app orders. India blends old trades with new tech.

GDP hit 6.2% to 7.5% in 2025, powered by services and travel rebound. Forecasts see 5.5% to 6.5% in 2026. Strong rains boosted farms; factories hired more. Earnings rose with jobs in IT and logistics.

Firms shift from China. Apple builds iPhones in the south. Wages stay low, skills high. Digital payments via UPI handle billions monthly. A street vendor scans a code; cash flows instant.

Young workers thrive. A graduate from Delhi codes apps for global firms. Salaries double in two years. This boom creates millions of roles. Economic Forecasts for Asia and the Pacific: December 2025 notes India’s pull on regional growth.

Services lead. Software exports top $200 billion yearly. Travel surges as flights fill post-pandemic.

Digital Tech Leads India’s Fast Expansion

IT hubs employ lakhs. Coders build cloud tools and apps. Job fairs draw crowds; training camps skill up youth. Exports to the US and UK climb steady.

Travel apps book trains and hotels. Domestic trips rise 20%. This mix fuels steady cash flow.

Southeast Asia Builds Strong Supply Chains and Diversifies

Factories in Vietnam’s Hanoi suburbs weld circuit boards. Singapore’s ports scan cargo with lasers. Workers in Malaysian clean rooms pack chips. The region turns trade winds to its favour.

Growth averaged 4.3% to 5% in 2025. Vietnam topped at 6.5%; Singapore held 4%. Forecasts dip to 3.4% to 4.4% in 2026 amid tariffs. Yet electronics exports soar. Malaysia sends 40% of goods as semis, 65% of its chips abroad.

Firms flee China costs. Vietnam lures with tax breaks; factories multiply. Indonesia mines nickel for batteries. ASEAN cuts reliance on one supplier. Tech for AI chips flows from here.

Diversification pays. Ports upgrade; roads link borders. Southeast Asia quarterly economic review: Q3 2025 tracks softer quarters but firm paths ahead.

Vietnam and Malaysia Shine in Manufacturing

Vietnam’s electronics plants hum. Exports doubled since 2020. Semis for AI servers ship to Taiwan and the US.

Malaysia refines chips. Penang hubs draw Intel and Infineon. Output ties to global data booms.

Singapore and Indonesia Weather Trade Storms

Singapore grows via finance and logistics. Fiscal aid cushions hits; GDP holds firm.

Indonesia boosts commodities. Nickel plants feed EV chains. Resilience shows in steady trade.

Asia Shapes World Trade Through Alliances and Deals

Summits in Hanoi see leaders shake hands over tea. BRICS meetings in Goa plot currency swaps. ASEAN forums ink free trade pacts. Asia writes the rules.

Exports beat forecasts in 2025 despite tensions. Investments dipped, but tech inflows rose. US tariffs loom for 2026, yet deals with Europe and Africa offset pain. Belt and Road builds bridges, literal and not.

Geopolitics sways. China ties ASEAN via rails; India pushes Quad security. Risks exist, like supply snags. Still, Asia sets agendas on climate and digital rules. 2026 Asia Outlook eyes balanced paths.

Forward momentum builds. Watch these moves.

Asia leads with grit. China at 5%, India above 6%, Southeast Asia near 5% in 2025. Factories, code, and ports drive it. Challenges like tariffs test, but alliances hold firm.

Growth balances ahead. Firms eye factories in Vietnam; investors bet on Indian apps. What region grabs your eye? Subscribe to CurratedBrief for daily updates on these shifts. Stay ahead in a world Asia shapes.